Your cart is currently empty!

China’s Commercial Vehicle Industry Unshaken by U.S. Tariff Hike

China’s Commercial Vehicle Industry Unshaken by U.S. Tariff Hike

90% of exports rooted in Belt and Road – Chinese cars gain global momentum despite external pressure.

As the U.S. government increases tariffs on Chinese goods, questions arise about the impact on China’s commercial vehicle sector. The short answer: limited. Chinese commercial vehicle makers are largely unfazed – with most exports heading to Belt and Road countries, not the U.S.

In 2024, China exported 904,000 commercial vehicles, but only 1.8% went to the United States. For new energy commercial vehicles, that number was even smaller — just 12,500 units, or 0.3%. The new tariffs may affect some high-end components, but they barely scratch the surface of China’s broader global expansion.

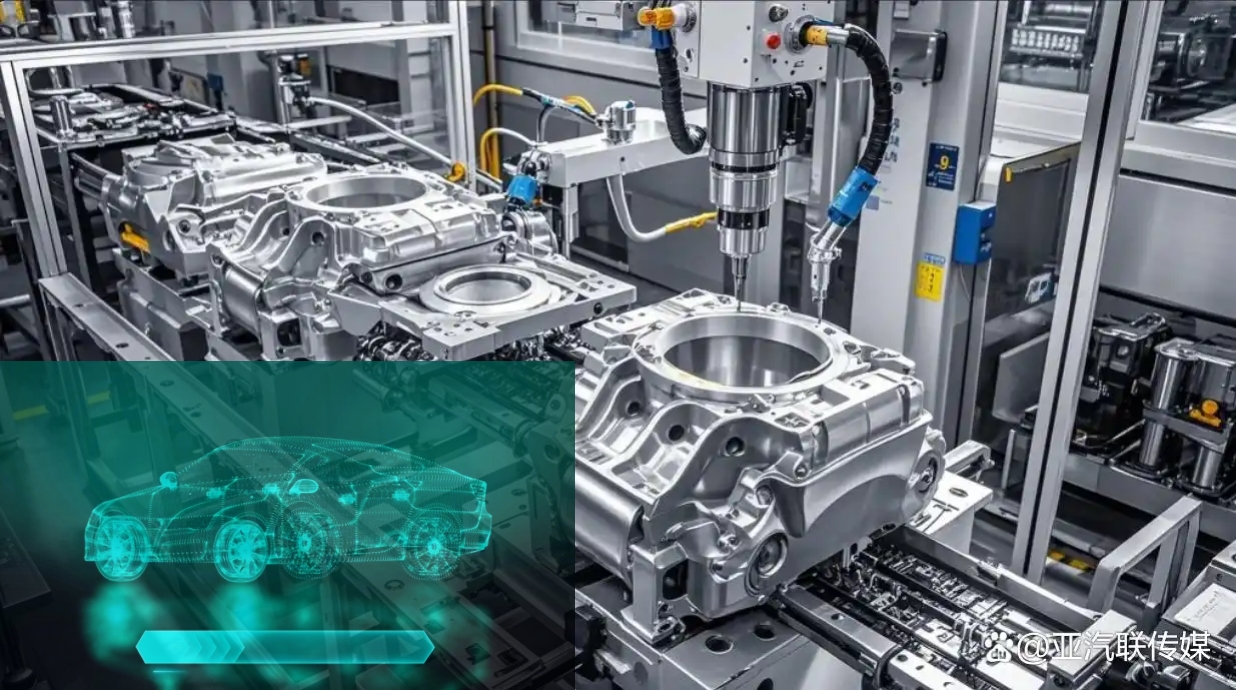

Domestic Innovation and Global Strategy

Chinese manufacturers are accelerating their transition toward self-reliance. Companies like Yuchai and Dongfeng have developed hydrogen fuel cells and in-wheel motors fully in-house. Yuchai’s latest hydrogen system boasts over 15,000 hours of runtime and has already been deployed in buses and light-duty trucks.

At the same time, firms are bypassing tariffs by going global. Take Shaanxi Auto for example — it operates 15 factories across the Middle East and Central Asia, with half of its overseas heavy-duty truck sales coming from these locations. Other companies are leveraging Mexico as a gateway to the North American market, exporting 445,000 vehicles to Mexico in 2024 alone — 6.9% of total exports.

More Opportunities, Less Dependency

U.S. brands hold less than 5% of China’s commercial vehicle market and may retreat further due to rising costs and policy pressures. In contrast, Chinese brands like BYD and Yutong have captured over 20% of the global new energy bus market and continue gaining traction in Europe and beyond.

While the U.S. market imposes new hurdles, China is eyeing fast-growing emerging markets. Southeast Asia and Africa, where commercial vehicle demand is growing at 12% annually, offer fertile ground. Chinese vehicles, typically 30% cheaper than European counterparts, have a competitive edge.

However, companies remain alert to possible ripple effects. Should the EU or Japan follow the U.S. lead in imposing tariffs, Chinese automakers may be pushed to localize production — as seen in Indonesia, which now requires 40% of vehicle parts to be locally sourced.

Long-Term Game Plan: Technology + Policy Support

The future of China’s commercial vehicle industry rests on three pillars:

Technological Self-Reliance: From autonomous driving systems by FAW Jiefang to Dongfeng’s 30+ national standards for EV components, Chinese firms are doubling down on innovation.

Global Expansion: Building overseas factories is not only a workaround to tariffs — it’s part of a long-term localization strategy.

Policy Backing: The Chinese government supports the sector with tax cuts, export subsidies, and a RMB 2 billion fund for domestic parts suppliers to scale globally.

Bottom Line

Tariffs may be disruptive in the short term — especially for high-end components and special-purpose vehicles — but China’s commercial vehicle industry is already adapting. With homegrown technology, smart supply chain strategies, and strong policy backing, Chinese trucks and buses are poised to follow in the footsteps of smartphones and appliances — becoming the next global symbol of “Made in China.”

Leave a Reply